Big Ten Rolls Out Multi-Network, $7-Plus Billion TV Media Rights Deal

The long-awaited Big Ten media rights deal is now official and, as anticipated, it is a revenue geyser: a seven-year agreement with multiple broadcast partners worth more than $7 billion plus escalators, sources told Sports Illustrated. The back-loaded deal, which begins in 2023, averages out to more than $1 billion annually.

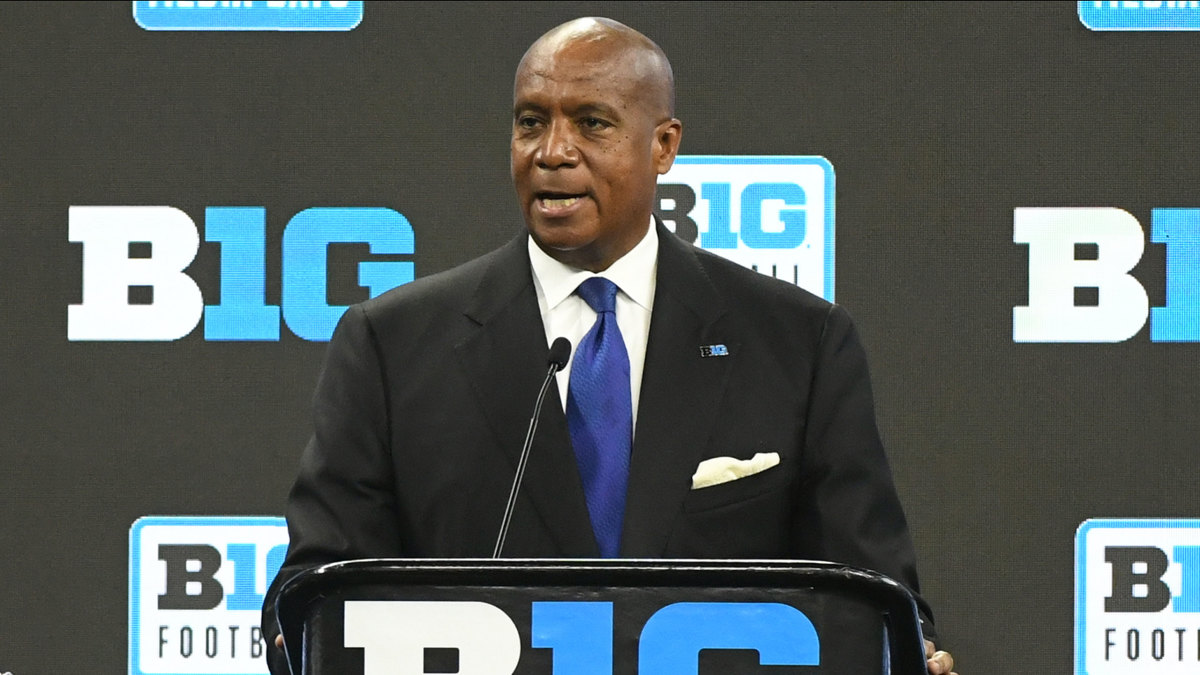

The agreement with Fox, CBS and NBC comes with this caveat from a Big Ten source: “We are not done expanding.” What that means—in terms of timetable, potential expansion targets and the overall stability of college athletics—was left unsaid. It could be posturing to keep the rival Southeastern Conference and others off-balance, or it could be an indication, as Big Ten commissioner Kevin Warren said in July, that further national realignment could come within the next few years, well before this new deal ends with the 2029–30 athletic calendar.

In terms of the current deal, it resets the bar for what universities can make on their media rights. When USC and UCLA are added to the conference in 2024, the annual payout over the lifetime of the agreement could average in excess of $70 million per member in the 16-team conference. (That windfall would not include additional conference disbursements, such as pooled bowl and NCAA basketball tournament revenue.)

“I think we were able to create a win-win-win opportunity,” Warren says. “I’m confident this will be very positive for all parties involved. It emphasizes the point that live sports are still in demand [as a broadcast commodity]. It was a unique and different experience, but I think people will look back and say it all worked out.”

Starting with the 2023–24 athletic season, Big Ten sports will be available across six different platforms: Fox and its affiliates, FS1 and the Big Ten Network; CBS, which is winding down its long-standing partnership with the SEC; and NBC and its direct-to-consumer streaming arm, Peacock.

“We just couldn’t be prouder and more excited to partner with these media brands,” Illinois athletic director Josh Whitman says. “The platform, the visibility, the partnerships … puts on really stable footing as we continue to move our way through a pretty unique moment in the history of college athletics.”

The notable omission is ESPN, which has aired Big Ten athletics for four decades; however, multiple sources said ESPN could still land an agreement to carry Big Ten content as a sublicensee, particularly in the basketball space. And in an unstable landscape, there is always the possibility of realignment sending everyone back to market to restructure contracts that add (or reinstate) broadcast partners.

“We have one more year with them,” Warren said of ESPN and the 2022–23 season. “They’re professionals, we’re professionals, and we’ve had a close relationship with them for a long time.”

The belief that the SEC is ESPN’s priority moving forward was solidified during negotiations, Big Ten sources told SI. In terms of a monetary offer and providing a dedicated time slot for football games, the Big Ten was left wanting more from ESPN.

Still, breaking up with the broadcast outlet that shows more college sports than any other comes with some inherent risk in terms of visibility.

“That was certainly a point of discussion for us,” Whitman said. “We’re incredibly grateful for the longstanding relationship we’ve had with ESPN. We look forward to having a great relationship with them for this next year, and continuing to explore ways to connect with them in the years ahead. Even without a formal, direct relationship, our two brands—the Big Ten Conference and ESPN—are just too prevalent throughout college athletics for there not to continue to be a number of intersecting points.

“I don’t think we expect this will be the end of the relationship. We’ll continue to be good partners with them in a slightly different way than we have.”

The addition of traditional broadcast titans CBS and NBC allows the league to expand its Saturday football game menu from noon until nearly midnight ET. The Big Ten lineup will be: Fox televising the league’s “A” game at noon; CBS keeping the 3:30 p.m. window it has employed with the SEC; and NBC broadcasting a prime-time game that comes on the heels of Notre Dame home contests. Fox will coordinate a game draft with the Big Ten office each year.

The inventory breakdown by platform will be as follows:

- Fox/FS1 will have 24–27 football games in 2023–24, then 30–32 games each of the next six years. It also will air four of the seven Big Ten championship games during the contract. Fox/FS1 will broadcast 45 men’s basketball games in ’23–24 and at least that many in the years thereafter, but none of the men’s conference tournament. They will have the option to broadcast “select” women’s basketball games and distribute “select” Olympic sports events.

- Big Ten Network will have 38–41 football games in 2023–24 before increasing to a max of 50 games for the rest of the deal. It will have a minimum of 126 men’s basketball games annually, including eight from the men’s basketball tournament prior to the semifinals and championship. BTN also will show a minimum of 49 women’s basketball games per season, including conference tournament games prior to the championship. BTN will continue to be the “primary home” of the league’s Olympic sports.

- NBC will have 16 football games in 2023 and 14–15 thereafter. That will include one championship game. The network that made its Sunday night NFL broadcasts a staple of American football viewing and carved out a college niche with Notre Dame will apply its same production value to the Big Ten prime-time window. Expect extensive cross-promotion between the NFL and Big Ten productions.

- Peacock, which won the direct-to-consumer part of the deal, will have eight football games per season for the length of the contract. It also will show 32 men’s basketball games in 2023–24 (20 of them conference matchups) and 47 thereafter (32 league contests). That will include an opening-night doubleheader from the men’s tournament. On the women’s side, Peacock will stream 30 games a season, 20 of which are conference play. Peacock also is a likely destination for a significant amount of Olympic sports coverage as part of a tie-in with NBC’s status as the American rights-holder for the Summer and Winter Olympics.

- CBS will air seven football games during the 2023–24 season, as it shares broadcast time with its SEC commitment. That will increase to 14 or 15 games per season thereafter and include two Big Ten title games. In men’s basketball, which CBS already has carried for years, the inventory will start with 9–11 games in ’23–24 and increase to 15 thereafter. Thirteen of those will be conference games from ’24 to 30. CBS will also get the semifinals and championship game of the league tournament, and the women’s tourney title game.

“From the moment we did not renew our SEC football package, we were solely focused on the Big Ten,” Sean McManus, chairman of CBS Sports, told SI. “The 3:30 window on CBS has been incredibly important to football fans and to us. We’ve done a deal that we think is really good for us and the Big Ten. We can’t wait to get started.”

The Big Ten football championship game rotation will be as follows: Fox in 2023, CBS in ’24, Fox in ’25, NBC in ’26, Fox in ’27, CBS in ’28 and Fox in ’29.

A Big Ten source stressed that the substantial revenue increases over the current deal will arrive in Years 3 to 7 of this contract. “Disbursements in Year 1 will be similar to the 2022–23 disbursements per school and begin to gently slope up in year two,” the source said. It’s a sprawling, multidimensional deal that speaks to the current nature of college athletics: Cash is king, and the rich are getting richer. Everyone is trying to catch up to the SEC and Big Ten—and, for now, the Big Ten just put itself in the lead in the revenue race.

However, keep an eye on how the SEC will react. It is believed that one of the league’s reasons for slow-playing its decision on whether to add an extra conference football game (from eight to nine) was that it was waiting to see what the Big Ten’s rights were worth. Could adding another layer of league play to the TV inventory be worth enough for the SEC to reopen its own rights agreement and seek more money? That remains to be seen. For today, the Big Ten schools are the ones counting their money and laughing all the way to the bank.

“This provides some financial stability for our schools, and some organizational stability as well,” said Warren, whose reputation has gotten a radical makeover with the league’s expansion and this revenue score after a rocky start to his tenure in 2020. “It’s been fun and intellectually challenging. Now the real work begins.”

Watch Big Ten football with fuboTV: Start a free trial today!

More College Sports Coverage: